WHCRWA Rate Unchanged in 2025

The WHCRWA announced that their rate for water usage will NOT be increased in 2025. The WHCRWA rate is a pass-thru cost, with no mark-up, to MUD 208 residents and is $4.35 per every 1,000 gallons used.

The WHCRWA announced that their rate for water usage will NOT be increased in 2025. The WHCRWA rate is a pass-thru cost, with no mark-up, to MUD 208 residents and is $4.35 per every 1,000 gallons used.

Higher summer water conservation rates are now in effect, go to Water and Sewer Rates

Higher summer water conservation rates are now in effect, go to Water and Sewer Rates

As a result of the ongoing power outages, WHCRWA, one of our major water suppliers, has started Stage 1 Drought Contingency and requested all districts do the same. We request that all MUD 208 residents follow our district’s Stage 1 Drought Contingency Plan.

Voluntary Water Conservation is in effect due to Hurricane Beryl. The MUD 208 Water Plant is running on emergency power, please continue the Voluntary Water Conservation until further notice.

MUD 208 will be repairing and replacing an underground water line and pavement on Royal Gardens at the Park Falls intersection. The work will start on May 1st and will take approximately 3 weeks. During this construction, Royal Gardens will be restricted to one-lane traffic at various times. Please use caution and follow warning signs when driving in this area.

Higher summer water conservation rates are now in effect, go to Water and Sewer Rates

Once again, we are all getting our yards back to the healthy, lovely green specimens they were prior to the abuse they suffered during the winter. Have you turned your sprinkler system on and walked the whole system? We recommend you do this to ensure your sprinkler heads are not broken and your whole yard is getting the proper amount of water that it needs. This should be done at the beginning of the irrigation season, and monthly throughout the season. This is especially true if you have a lawn service and your system runs overnight as you might not realize one of the sprinkler heads is broken and you have a fountain that is spraying water everywhere. Remember water is getting more expensive, mostly from charges passed on from the West Harris County Regional Water Authority (WHCRWA). Also, you don’t need to water your lawn daily. You want to apply about a half-inch to an inch in order to soak the soil deeply. Then allow it to dry out, bringing air back into the soil, before you give it another thorough soaking. This saves water and helps develop a good-rooted, resilient turf.

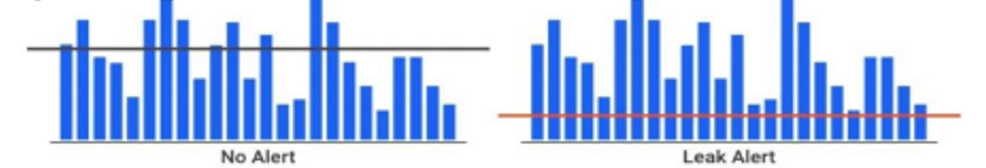

All MUD 208 residents now have smart meters that allow users to access their water usage online and set up leak alerts. Unfortunately, many residents are not taking advantage of this FREE tool, the EyeOnWater app. Once registered for an online account, customers will be able to see how water usage spikes on the days their sprinkler system is active. Another advantage is that customers can receive leak alerts. With this feature, if water is flowing continuously for 24 hours at a customer specified rate, say 1 gallon per hour, the customer is notified by a text and/or email that their household has a leak. For example, the first graph below shows usage did not reach the set threshold line every hour so no alert is sent. In the second graph, usage exceeded the set threshold line every hour for 24 hours so an alert is sent.

Once a 24-hour period goes by with water flow less than the specified value, an alert is sent that the leak has stopped.

The EyeOnWater app lets you be in control. How’s that you ask? It allows you to engage with how you use water and see your latest water usage, understand how much water you use, detect leaks and discover when you use the most water. It also lets you:

Plus, you can easily contact us! This is all simply at your fingertips and part of our service with the smart meters!

There are several ways to sign up for EyeOnWater. You can click on this link Smart Meter Account Sign Up which will send you to the smart water meter webpage on this website. Another way to sign up is with your smart phone. Scan this QR code below to be directed to the EyeOnWater website or find EyeOnWater in the app store.

No matter how you sign up, you will need the following information to register your account:

Start taking control of your water usage – sign-up now!

The Board of Directors of Harris County MUD 208 (the District) voted an across-the-board water rate increase to our customers. The base rate (minimum charge) has increased by $1.50 and the usage tiers have increased by $0.50 per 1,000 gallons. To view the new rates, go to Water and Sewer Rates. This is the first overall water rate increase in the District’s water fees since 1996, that is 28 years ago. In 2010, to aide in the District’s water conservation effort, a 4th tier was added to the rate structure for >30,000 gallons a month users. The sewer rate has increased by $1.00 to $16.00 flat rate. With these increases, the average water user in our District will see approximately a $3.00 increase monthly. For top water users (> 30,000 gallons) the increase would be about $17.00. These new rates equate to about a 6% increase (this percentage varies depending on actual usage).

The monthly water bill has 3 components, the Base Water Charge (District’s water rates), the Base Sewer Charge (District’s sewer rate) and the WHCRWA Charge (West Harris County Regional Water Authority rate). The District’s sewer rate is not only based on the sewer system infrastructure maintenance costs but also a user connection fee imposed by CJOB (Copperfield Joint Operations Board) who manage the sewage treatment plant. The WHCRWA charge is a pass-thru cost to our customers and is currently at $4.35 per every 1,000 gallons used. The District has no control over the WHCRWA rate.

The District’s Board felt this water rate increase was necessary as a result of rising costs as well as an aging infrastructure that is requiring more repairs as well as major component replacement and upgrades, see Aging Infrastructure & Drought-Like Weather – A Bad Combination article below.